Depending on your unique circumstances, the idea of preparing pay slips in MS Excel might not make much sense. After all, many off-the-shelf payroll applications, with pay slip generation capability, already abound in the market place.

I offer a few answers/reasons in this article, which is actually the first in a series, that reveal situations in which adopting MS Excel for this purpose, would be justifiable.

This series is aimed at providing responsible managers (and/or CEOs) in companies practical, experience based ideas, for customising MS Excel, to dramatically enhance handling of salaries data, and generation of pay slips/other relevant reports.

————-

“Everybody knows some Excel, but stop seeing Excel as an office program that everybody MASTERS and that is used to organize numbers in columns and make a few calculations. Excel is the best reporting application on the market and it is fully programmable with its own PROGRAMMING LANGUAGE within called VBA”

– Pierre LeClerc PLI Consulting Inc

————-

For seven years before 2002, I worked as a Graduate Trainee, later Process Manager, and then Head of Department, in a large multinational manufacturing company.

During that time I used my spare time to develop and implement custom spreadsheet based solutions. that were adopted for formal use by departmental heads in the company.

Between 2007 and now, I have worked closely – as a service provider – with CEOs, and/or with the companies’ key personnel/decision makers in small, medium and large client companies, to do the same thing.

During these two lifetimes, I have identified four factors that most frequently prevent many of the companies I studied from setting up effective systems for managing . salary data and pay slips preparation. I discuss those factors below, and suggest possible remedies.

1. Cost of Off-The-Shelf Payroll Applications

As earlier mentioned, a variety of payroll applications are available for off-the-shelf purchase. Feedback from associates about shortcomings of some such applications (or indeed painful past experience), could discourage their adoption by companies wary of wasting scarce financial resources.

Except for those who buy pirated software, purchasing original licenses of software for commercial use tends to be a bit expensive, depending on the application and provider. To make the investment, and later discover the application does not exactly suit your needs can be frustrating.

The saying that all fingers are not equal also comes to mind here. Some companies can absorb the shock of a bad purchase. But there are others who would feel the pinch a lot more. The latter would therefore be understandably keen to avoid making the mistake, of buying software that does NOT suit their needs well enough.

For such companies, customising MS Excel to prepare pay slips could therefore be a preferable COST-SAVING temporary alternative. This especially when you consider that MS Excel is likely to be already installed on their PCs.

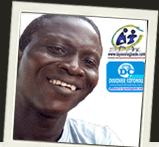

Above – Figure 1: Screen shot of Automated Data Handling Form in an Excel-Visual Basic driven Payslip Generator

Over time, this custom system could help them more accurately identify specific features and functionalities; they want to see in an off-the-shelf application. That insight gained, would prove useful – in future – if they opt to buy, & funds are available.

2. Attitude of Business Owners/Decision Makers

For some strange reason, some companies (especially small/medium entreprises) in this day and age, lack even basic paper based salaries – and other – data management systems. As a result, preparation of pay slips – and other reports – tends to be a cumbersome process – that is, if at all they consider it necessary to do them.

I have often seen this kind of situation, in SMEs where the owner has had little or no formal experience working in a structured organisational workplace, prior to starting the company. S/he would NOT be bothered to invest in such systems, referring to them as needless formalities.

The personnel (e.g. accountants, HR/Admin/General Managers) saddled with the responsibility of managing employees salaries data, in this kind of workplace situation, is likely find customising MS Excel to achieve the same purpose, a worthwhile venture.

S/he will of course have to start by FIRST of all, putting in place a paper based employee records management system to be used in updating the MS Excel based system that will be setup on the PC.

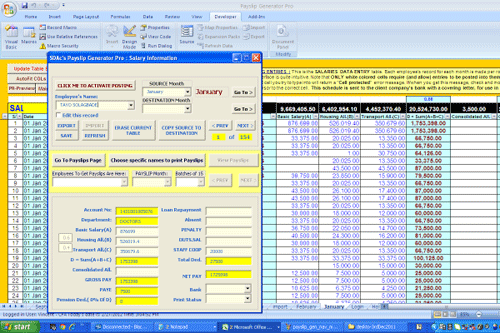

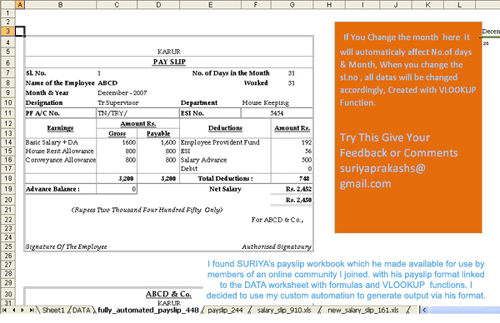

Above – Figure 2: Screen shot showing a simple 2 pay slips to a page worksheet (the pay slips linked via simple formulas and VLOOKUP functions to a Salary Schedule sheet named “DATA”) in an MS Excel workbook found online – see the custom automated version in Figure 3 (below).

3. Manual Systems/Personnel Workload

Some companies which do have reliable paper based payroll systems in place, do not bother to generate and issue their employees pay slips.

Sometimes this happens because the responsible manager has a heavy workload, to which s/he is unable to add the task of preparing pay slips using a manual process.

Further more, the number of salaried persons to be given pay slips could be in tens or hundreds. The idea of generating relatively large numbers of pay slips, using an existing manual process could effectively discourage the responsible personnel. And except management expressly demands it, they would likely prefer to avoid doing it.

One Example: Two companies that use a basic version of my automated Pay slip Generator (e.g. no automated modeless data entry forms), each have more than 120 employees. Before they began using my application, their pay slips were always hand-written for each employee into pre-printed paper pay slip formats.

This was done because management insisted each staff be issued one monthly. According the accountant for one of those companies, it used to take them at least a week, to get all the pay slips done!

4. Temporary Staff

Certain companies already have a working system that takes care of permanent/regular as well as contract employees.

However, perhaps due to the way they operate, say in plants or factories, they have to regularly take on and/or disengage temporary workers on a continuing basis e.g. for overnight offloading, process line packaging, etc.

Generally, many of these “temps” are typically low/un-skilled hands, or students on industrial attachment etc. But they still need to be paid, and such payments captured comprehensively for administrative and accounting purposes.

It is the situation described above in particular, that I believe could make the use of MS Excel to prepare pay slips beneficial. For instance, the manager responsible would be able to use the MS Excel based alternative, to minimise the hassle normally arising from manually tracking and making payments (or reconciling issues). Items 1, 2 and 3 of course also have potential benefits, if they are addressed.

Above – Figure 3: Screen shot showing the pay slips generation page from Figure 2, AFTER custom custom automation had been introduced into it, by CB Studio. Note the buttons for automated LOGO Addition and export of ready-to-print multi-page Pay slips report.

Government/The Law: A Compelling Reason To Setup A System That Works

For any business owner, decision maker or responsible manager, the government’s requirement for compliance with income tax laws, should provide a healthy incentive to setup a reliable system to handle employee salaries data.

The details vary from country to country, but generally, companies are required to deduct a prescribed amount (as income tax) from each employee’s earnings, for onward remittance to government’s revenue collection agency. There are also other deductions to be made for pension, health insurance etc.

When the necessary computations to extract these different figures have to be manually done (e.g. using hand held calculators) for tens and even hundreds of employees, the propensity for error dramatically increases. Yet, neglecting to do them will make it difficult to file accurate returns. On one hand you could over pay, effectively short changing your company, while on the other, you could get into trouble for failing to make complete returns.

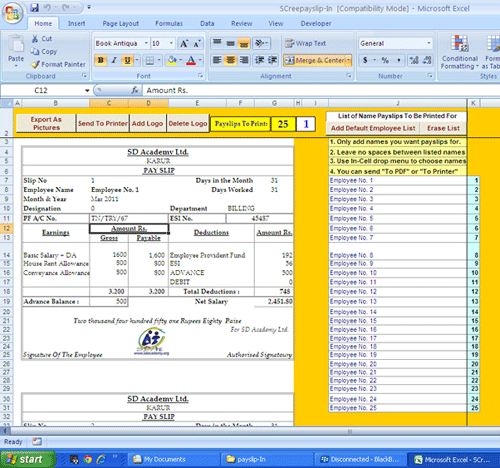

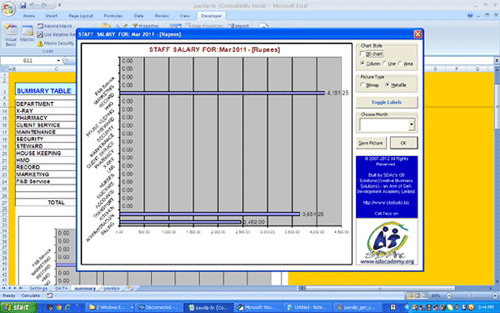

Above – Figure 4: Screen shot of Automated Chart Plotter interface in an advanced version of CB Studio’s Payslip Generator

Considering the serious and sensitive nature of issues relating to salaries, taxes and pensions, no smart company or manager would want to be found wanting (by employees or the government) in this regard.

If you cannot deal with using off-the-shelf apps, do yourself a favour and setup an alternative system that works – on paper and/or in MS Excel or other spreadsheet application that suits you.

And that’s why I believe that at the very least, an MS Excel based Salaries Management and Pay slip Generation system would be worth looking into, even if as a temporary alternative.

Final Words

If YOU plan to use the ideas offered in this piece, to setup a spreadsheet based system that handles your company’s employee salaries data, be sure to get whatever authorisation you may need from relevant quarters.

Lastly, it is of course NOT unreasonable for me to assume, that you KNOW how to prepare a functional paper based system from which data to be posted into a basic PC based system built in MS Excel, can be readily obtained. If my assumption is wrong, then I urge you: get COMPETENT help to set that up FIRST, or you’re going to end up doing a lot of double work!

NB: This is the first is a series of planned educational commercials for my Payslip Generator Coaching program. You can get a FREE download of a PDF version of this write-up from this page (no opt-in required).

Next Post To Be Published In This Series: Using MS Excel To Prepare Pay slips – 5 Costly Mistakes You MUST Avoid.

Click here to join my mailing list, and get notified when this next post in the series is published.

BUILT-IN EXCEL SOLUTIONS DEVELOPMENT

Self-Development Academy’s Excel Heaven™ is the FIRST provider of Preprogrammed and Custom Spreadsheet based solutions in Nigeria. We offer Workbook Auditing/Optimisation and VBA Automation; Custom Spreadsheet Software Development; Sales; Job-Based Spreadsheet Coaching; and Consulting/Advisory Services on effective application of spreadsheets for business use. Call 234-803-302-1263.

See video demos of some of our real-life apps at http://www.youtube.com/user/TKSolagbadeSDAc

Visit our Excel Heaven mini-site at : http://www.excelheaven.tayosolagbade.com

Warning: count(): Parameter must be an array or an object that implements Countable in /home1/tayoswdg/public_html/sdnuggets/wp-includes/class-wp-comment-query.php on line 399